fsa health care limit 2022

The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. You can use funds in your.

For plan year 2022 in which the.

. Back to main content. Figure represents the average of costs for annual care of an infant and a 4-year-old. Elevate your health benefits.

And if an employers plan allows for carrying over unused health. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and. FSAs are limited to 2850 per year per employer.

Flexible spending account FSA for health care Health care FSAs 2021 2022. In urban areas the cost is for care at a child care center and for home care in rural areas. Easy implementation and comprehensive employee education available 247.

Unused funds can be carried over to the following year to cover future health care expenses. You can contribute pretax dollars to. The Internal Revenue Service IRS has announced an increase in the Flexible Spending Account FSA contribution limits for the Health Care Flexible Spending Account HCFSA.

As a result the IRS has revised contribution limits for 2022. The 2022 limits for. Choose Your Deductible Coverage Co-Pays and Get Customized Plan Recommendations.

Ad Reimbursement Accounts Designed To Empower Confident Spending Savings Decisions. In urban areas the cost is for care at a child care center and for home care in rural areas. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022.

Health Care FSA Limits Increase for 2022. 2022 Flexible Spending Accounts. The IRS has released Revenue Procedure 2021-45 confirming that for plan years beginning on or after January 1 2022 the health FSA salary reduction contribution limit will.

Hasnt confirmed the maximum for 2022 Ms. 2850 Health Savings Accounts HSAs Annual contribution. Step 2 Enroll to.

IRS annual contribution limit for 2022. Get a free demo. Among other things the notice indicates that employee contribution limits toward health flexible spending arrangements also known as flexible spending accounts or FSAs.

The Health Care standard or limited FSA rollover maximum limit will increase from 550 to 570 for plan years beginning on or after January 1 2022. Health FSA including a Limited Purpose Health FSA 2 850 year. Ad Find Obamacare Health Insurance Plans in Your Area.

The 2021 contribution limit for an individual is 3600 annually and for a family is 7200. The IRS released the 2023 annual limits for HSAs and HDHPs in Revenue Procedure 2022-24 in May 2022. We will update this page as the IRS releases more 2023.

The limit set by the Internal Revenue Service was 2750 for 2021 but employers may set lower limits for their workers. Maximum salary reduction contribution. A flexible spending account FSA is an employer-sponsored benefit that helps you save money on many qualified healthcare expenses.

Ad Custom benefits solutions for your business needs. The annual contribution limit for your health care flexible spending accounts health FSAs is on the rise for 2022 according to the Society for Human Resource. But employers may offer either a.

If the employees combined dependent care fsa contributions nonetheless end up exceeding the 5000 limit the excess. Enter Your ZIP Code to Start. For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of.

A few fast facts about FSAs. For 2022 you can contribute up to 2850 in your health fsa. If you provide health care FSA employer contributions this amount is in addition to the amount that employees can elect.

If youre married your spouse can put up to 2850 in an FSA with their employer too. If you have a dependent care FSA pay special attention to the limit change. Unused health and dependent care FSA funds are forfeited at the end of the plan year known as the use it or lose it rule IRS Notice 2005-42.

Employees can deposit an incremental 100 into their health care FSAs in 2022. Health FSA maximum carryover of unused amounts 570year. Figure represents the average of costs for annual care of an infant and a 4-year-old.

Participating in a Health Care Flexible Spending Account is a way of putting money aside tax-free throughout the year and then.

Dr Talbot S Pulse Oximeter In 2022 Pulse Oximeter Career Planning Pulses

Free Image On Pixabay Money Icon Dollar Giving Badge

Good News For Associates Participating In Flexible Spending Accounts The Exchange Post

Best Health Insurance Companies 2022 Top Ten Reviews

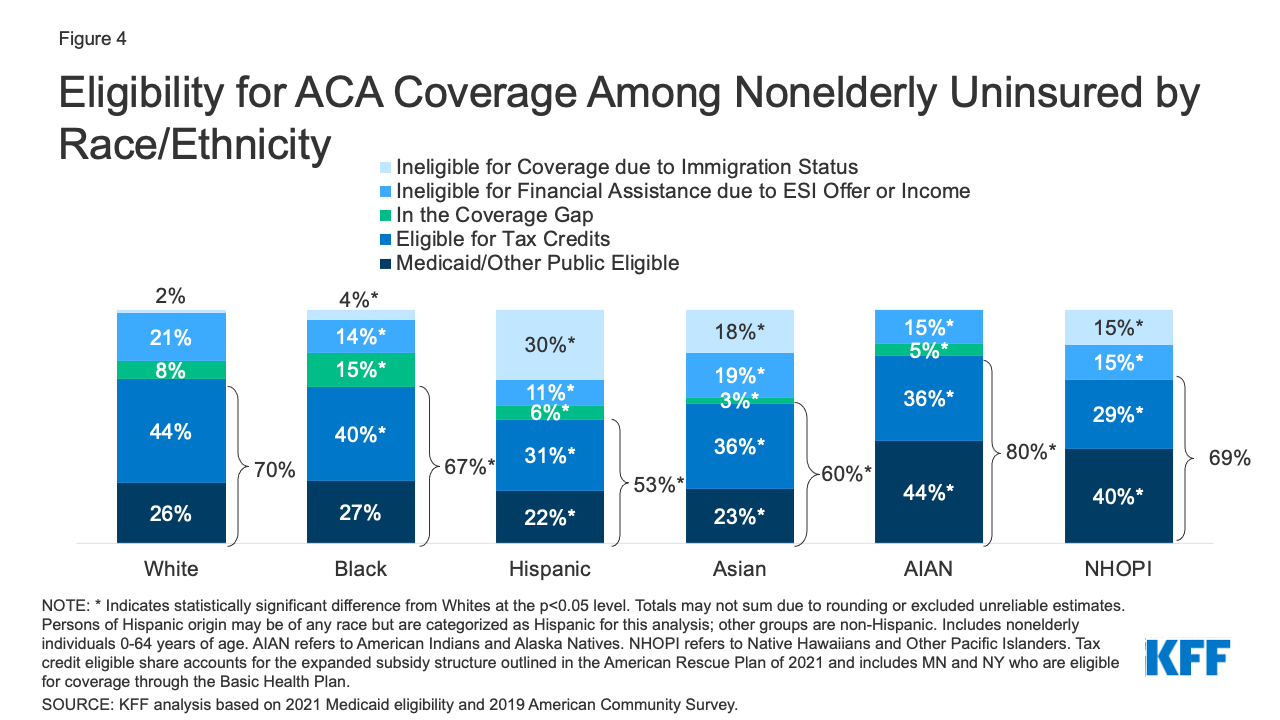

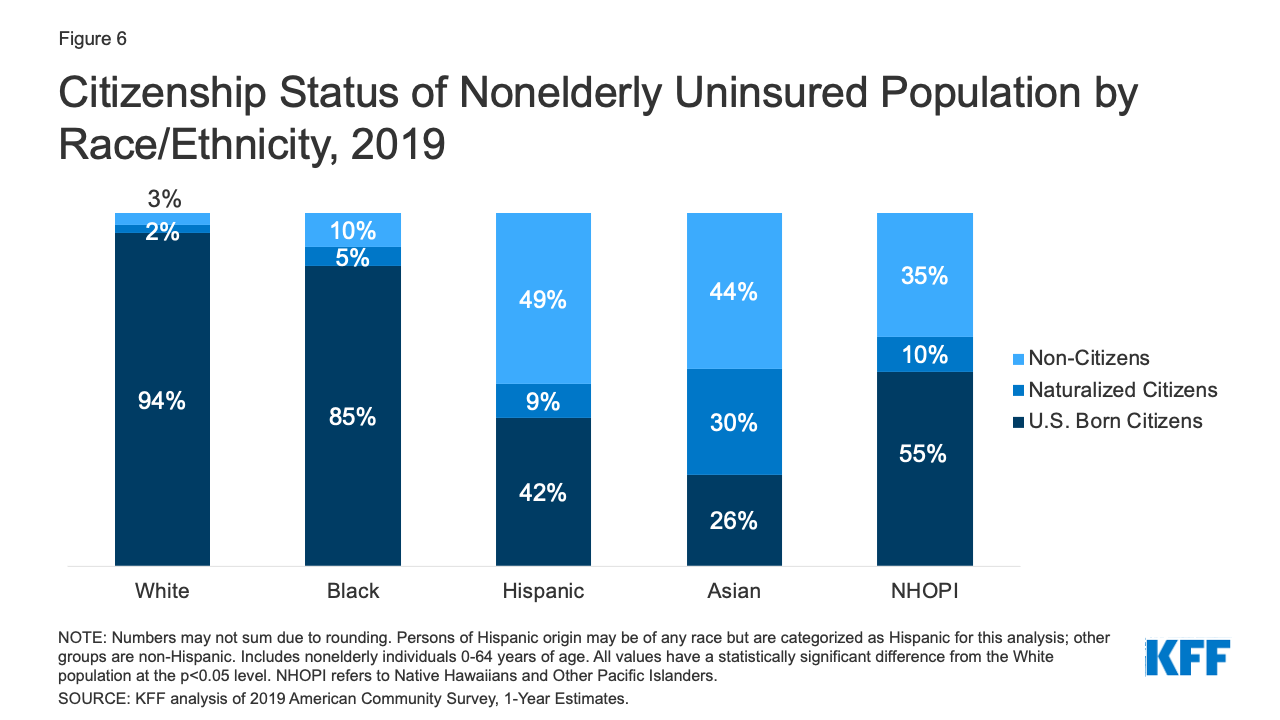

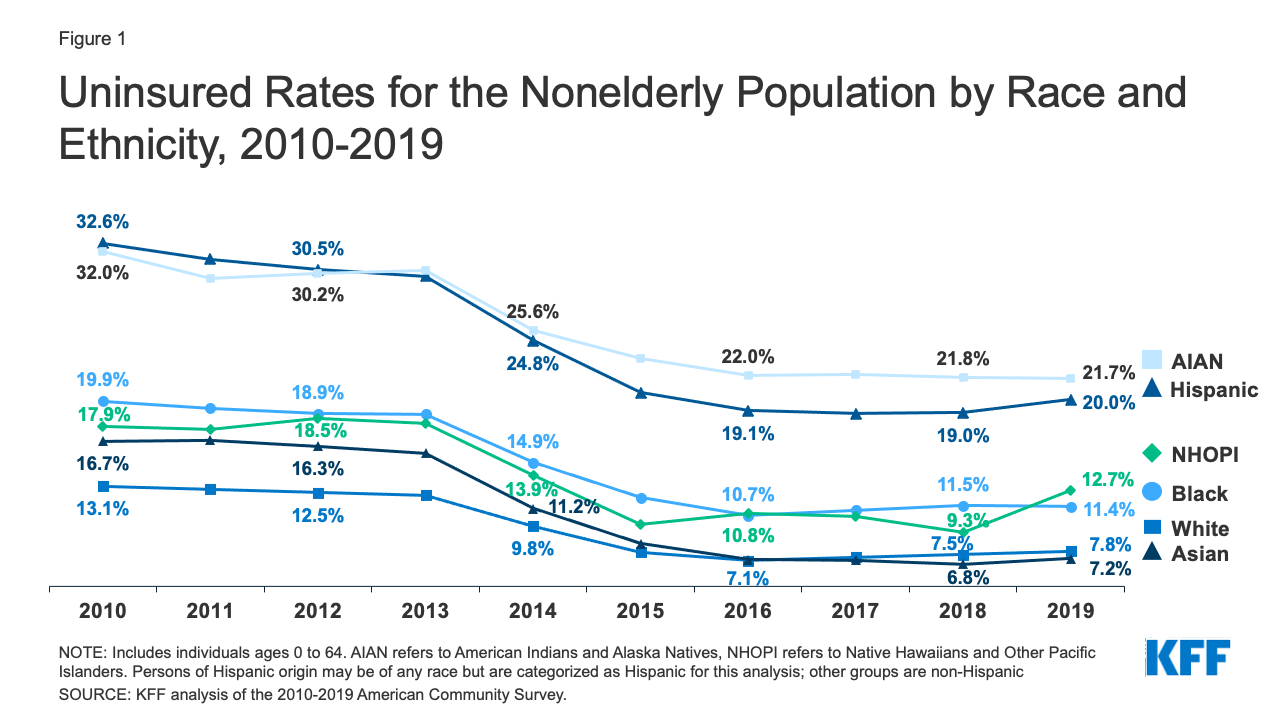

Health Coverage By Race And Ethnicity 2010 2019 Kff

/GettyImages-1296010517-8dcd33d7cb134887a312b8dfbb0e4681.jpg)

What Are The Pros And Cons Of A Health Savings Account Hsa

Tucks Multi Care Kit Witch Hazel Pads Lidocaine In 2022 Lidocaine Witch Hazel Lidocaine Cream

What Is The Maximum Hsa Contribution Limit For 2023 Goodrx

2021 Year Planner Hra Consulting Photo Calendar Template 2022

Benefits United States Medical

Irs Releases 2022 Health Savings Account Hsa Contribution Limits

Health Coverage By Race And Ethnicity 2010 2019 Kff

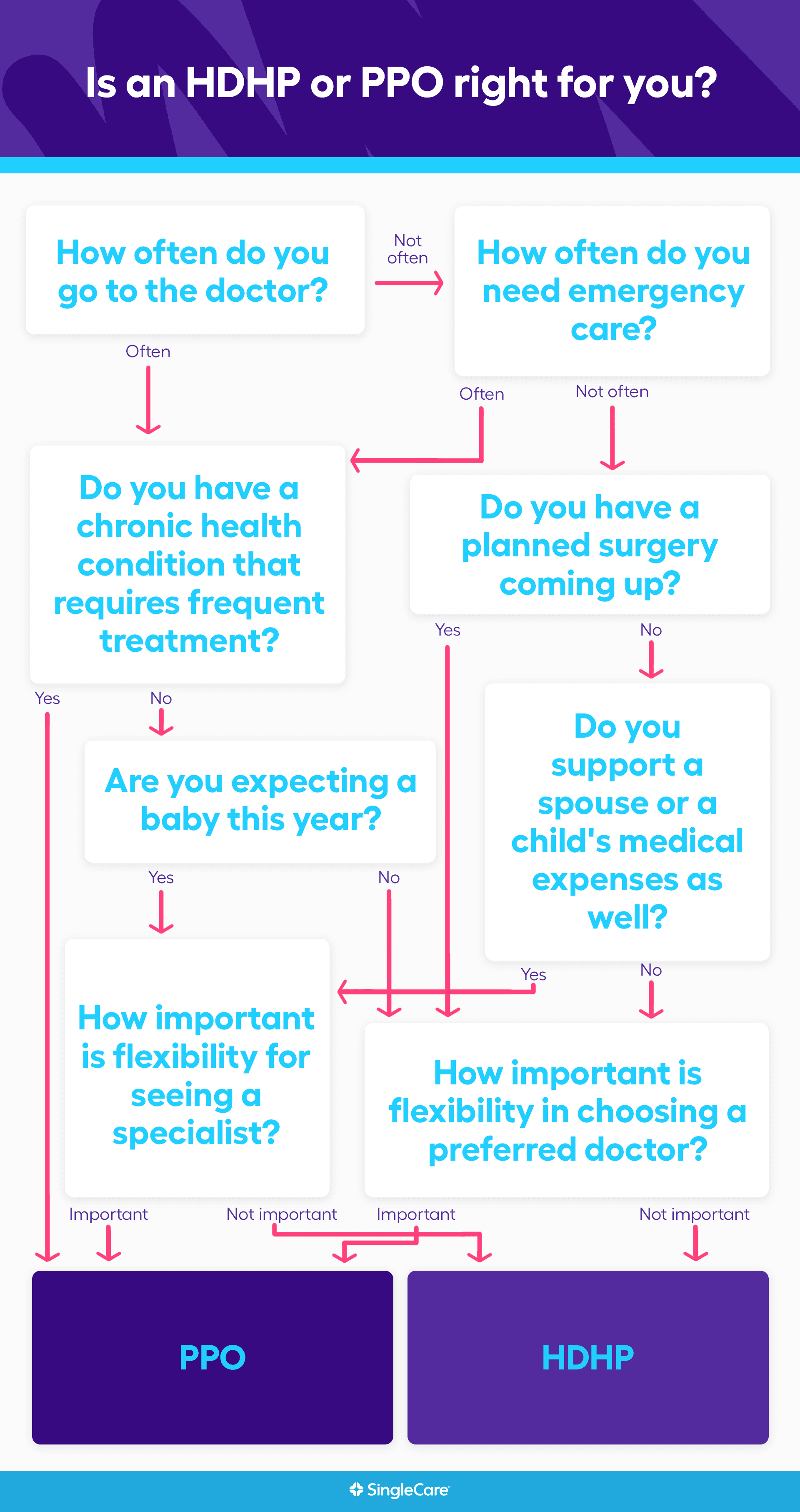

Hdhp Vs Ppo What S The Difference

Hdhp Vs Ppo What S The Difference

Can I Pay For Mental Health Care Using My Fsa Or Hsa

Wegovy Or Saxenda For Weight Loss Goodrx